Bay Area Medicare Options

At Bay Area Medicare Options, we’re dedicated to finding you the perfect Medicare plan tailored to your needs, so you can focus on enjoying life in the Bay Area with peace of mind.

About

Family Owned Open Year Round

As a dedicated family-owned business, with over 50 years of experince, we pride ourselves on delivering exceptional insurance services year-round. Our commitment to personalized care ensures that your insurance needs are met with the attention and expertise they deserve, whenever they arise. Whether you’re looking for guidance or support, we’re here to provide reliable solutions tailored to your unique situation.

-

Agents on call

- Judith Manuell: +1832-316-6007

- Sabrina Jacks: +1832-361-0411

- Brandon Jacks: +1281-628-1974

.jpg)

Medicare Advantage

Annual Enrollment Begins Oct 15th 2024

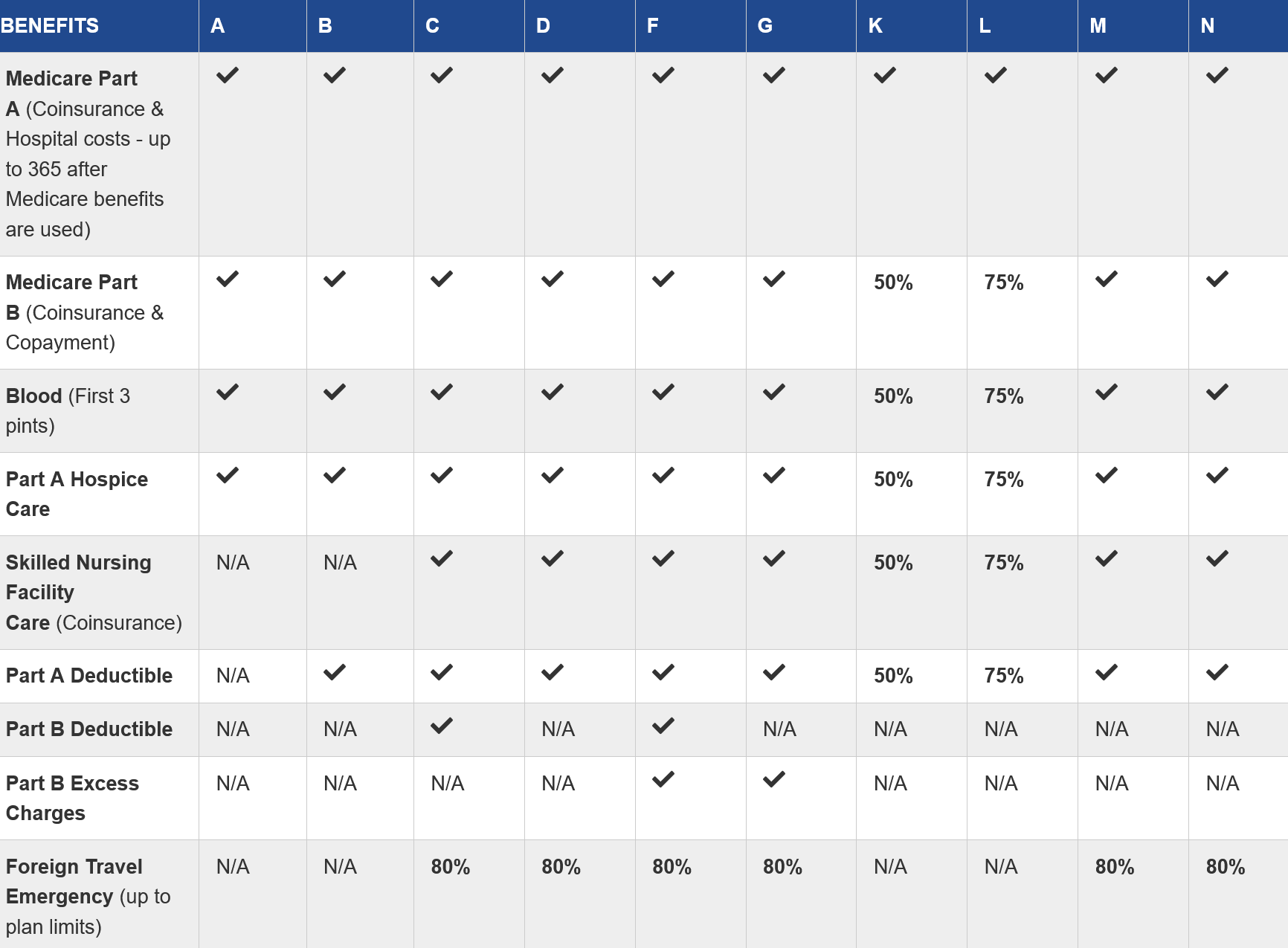

Medicare Supplements

We Offer Assistance With The AFFORDABLE CARE ACT (Obamacare)

Open Enrollment Begins Nov 1st 2024

Ancillary Products

Frequently Asked Questions

1. What is Medicare?

Part A (Hospital Insurance) Helps cover:

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice care

- Home health care

Part B (Medical Insurance) Helps cover:

- Services from doctors and other health care providers

- Outpatient care

- Home health care

- Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Many preventive services (like screenings, shots or vaccines, and yearly “Wellness” visits)

Part D (Drug coverage)

Helps cover the cost of prescription drugs (including many recommended shots or vaccines).

2. When am I eligible for Medicare?

Generally, medicare begins when you turn 65 years of age OR have been receiving disability benefits for 24 months.

Refer to the Medicare and You Handbook on Medicare.gov for all eligible periods.

3. Is there a cost to Medicare?

You usually don’t pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working for a certain amount of time. If you aren’t eligible for premium-free Part A, you may be able to buy it.

The standard Part B premium amount in 2024 is $174.70. Most people pay the standard Part B premium amount every month. If your modified adjusted gross income is above a certain amount (in 2024: $103,000 if you file individually or $206,000 if you’re married and file jointly), you may pay an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium. To determine if you’ll pay the IRMAA, Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

4. What are the Medicare penalties?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%.

If you don’t sign up for Part B when you’re first eligible, you may have to pay a late enrollment penalty for as long as you have Part B.

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may have to pay a late enrollment penalty if you enroll at any time after your Initial Enrollment Period is over and there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage.